The market value of Musk Lightning in China rose by 594.4 billion yuan!

"Iron Man" can’t sit still, he will come when he says it, and he will leave when he says it.

Musk’s trip to China lasted less than 24 hours, but it boosted Tesla’s share price by over 15%, and its market value increased by over 82.1 billion US dollars (about 594.4 billion yuan). Has the purpose of this "unexpected trip" been achieved?

According to Agence France-Presse quoted by the Global Times, Musk, CEO of Tesla Corporation of the United States, left Beijing on April 29 in his private jet. According to information from the flight tracking platform, the destination of the plane was Anchorage, Alaska.

Beijing business today reporter learned that Musk arrived in Beijing on the afternoon of 28th. Reuters said that Musk’s trip to China had not been made public before, and the report described it as "an unexpected visit" to China.

However, according to the Global Times, a person familiar with the matter said that Musk’s trip was to meet Chinese officials in Beijing to discuss the launch of the fully autonomous driving (FSD) system in China and seek approval.

Earlier this month, Musk said on social platform X that he would launch FSD technology to China users "soon".

According to national business daily, during Musk’s visit to China, Tesla has indeed taken an important step in the compliance of smart driving in China.

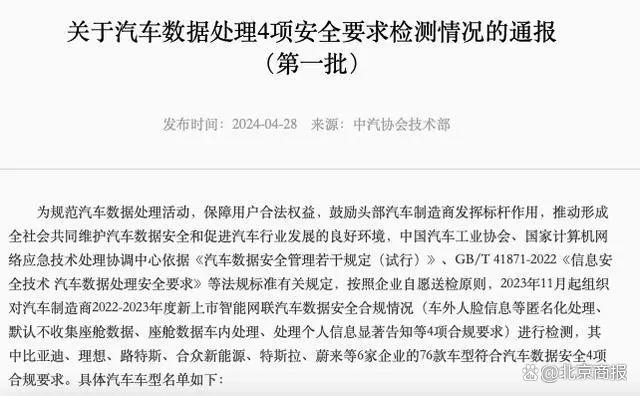

On April 28th, the China Automobile Association officially issued the Notice on Testing of Four Safety Requirements for Automobile Data Processing (the first batch), in which 76 models of six enterprises, including BYD, Ideality, Lotus, Hezhong New Energy (Nezha Automobile), Tesla and Weilai, met the four compliance requirements for automobile data security.

According to CBN, Tesla said that all localities have successively lifted the ban on cars with intelligent network connection such as Tesla.

According to the Securities Times, according to the Tesla user APP, the description of the purchase page of Tesla China’s official FSD service has been changed from "coming soon" to "coming soon".

It is worth mentioning that Musk is worthy of "bringing his own hot search physique". During his more than 20 hours in China, topics such as "Musk arrived in Beijing", "Musk claimed to be a fan of China" and "It was reported that Tesla China version of FSD cooperated with Baidu" dominated the hot search list.

According to CBN, the reporter asked Baidu about the rumors of cooperation. As of the afternoon of the 29th, Baidu did not respond.

On the afternoon of 29th, Baidu’s share price rose by more than 6%, and then rose by 4.36% to HK$ 105.3.

According to the Global Times, Musk’s trip coincided with the Beijing Auto Show. Tesla had no booth at the auto show, and the last exhibition was in 2021.

At present, Tesla urgently needs a new growth curve, and FSD also urgently needs to be realized in major markets.

According to the financial report data released by Tesla in the first quarter of 2024, Tesla’s revenue in the first quarter was $21.3 billion, down 9% year-on-year. The data shows that in the first quarter of this year, Tesla produced 433,400 vehicles and delivered 386,800 vehicles, both lower than Wall Street’s expectations.

Among them, the delivery volume in the first quarter decreased by 8.3% year-on-year and 20.1% quarter-on-quarter. This is also the first year-on-year decline in Tesla’s quarterly delivery in the past four years.

Musk pointed out at the first quarter financial report that the future is not only electric, but also autonomous.

According to 21st century business herald, he has repeatedly stressed that FSD is the most important profit source for Tesla’s automobile business in the future.

However, it is worth noting that on April 26, local time, the National Highway Traffic Safety Administration (NHTSA) announced that it had started a new investigation on Tesla.

The survey vehicles include Model Y, Model X, Model S, Model 3 and Cybertruck, which were produced in the United States from 2012 to 2024 and equipped with the assisted driving system Autopilot.

It is reported that the main reason for Tesla’s investigation this time is that there have been many collision accidents after the vehicle was recalled and the software was updated, and the preliminary test results of the regulatory authorities have also caused concern. Although Tesla announced the recall of more than 2 million vehicles in December 2023, and upgraded the function of the assisted driving system Autopilot, its safety was still questioned by NHTSA.

West street observation

Musk came to China to vote against "overcapacity"

After violating the Beijing Auto Show for five years, the return has become the top stream.

Wang wants to see Wang. Lei Jun started, Zhou Hongyi joined in the fun, and the car company CEOs all went off in person. Learn skills and cheer each other up. This social gathering has created a sense of sight for new energy car companies in China to "meet at the top".

No wonder, Iron Man can’t sit still, so he will come at once.

On April 28th, the State Council Prime Minister Li Qiang met with Tesla CEO Musk in Beijing. Li Qiang said that China’s super-large-scale market will always be open to foreign-funded enterprises.

Super-large market, many participants, fierce competition, and many innovations. China market is not only a stage for Chinese and foreign car companies to compete in the same field, but also a challenge ring.

The auto show is an arena and a public opinion field.

Lei Jun, a non-stop roadshow, Li Bin, who sings K out of tune, Zeng Yuqun, who haggles in English, and Wang Chuanfu, who crowded the subway to watch the auto show, have all written their marketing intentions and ambitions to sell cars on their faces.

Musk’s trip to China was not disclosed in advance, and the purpose of coming to China was also different. The heavy news circulating in the market, FSD’s entry into China is expected to speed up, and Model 2 will be listed next year.

Although he did not show up at the auto show, Musk chose to flash at the node of the auto show, which has naturally formed a public opinion bundle with the auto show. He generously said, "I’m glad to see the progress of electric vehicles in China, and all cars will be electric in the future.".

Disapproving of the "overcapacity theory", the attitude of entrepreneur Musk is clear at a glance. Behind this, from the market feedback, the answer is obvious whether China and the United States should be partners or rivals.

Musk’s trip to China lasted less than 24 hours, but it boosted Tesla’s share price by over 15%, and its market value increased by over 82.1 billion US dollars.

Supermarkets are open, win-win, yours and mine.

As the beneficiaries of economic globalization and trade liberalization, multinational enterprises allocate resources around the world based on the laws of market economy in order to maximize profits.

No matter what KPI Musk brings to China, it’s certain to share the cake in China’s supermarkets. Smart foreign companies can figure out what it means to invest in China.

The penetration rate of new energy passenger cars in new car sales has reached 42.3%, and the market has already passed the initial early adopter stage and is moving towards the mainstream public. Traffic marketing has increased market attention and cultivated consumers’ cognition and identification of new energy vehicles.

The auto show has returned and become a new "top stream", which was also born under the background of the soaring new energy vehicles in China. China’s auto market has always been the largest and most profitable market in the world, especially in the field of new energy vehicles.

At present, the global new energy vehicles show a cooling trend, and China’s new energy vehicles account for more than two-thirds of the global new energy vehicle sales, setting a record high.

The flow of the sky is the table, and the competitiveness of the hard core is the inside. No matter Lei Jun or Musk, no one wants to miss it, and no one can take it lightly.

Ten years ago, Musk registered a Weibo account. His first Weibo wrote: "We are going to do the right thing for you in China market."

Those so-called "overcapacity" and "decoupling" arguments, even if the White House is interested, Musk will not agree.

Comprehensive beijing business today (commentator Tao Feng reporter Liu Yang Liu Xiaomeng), Global Times, 21st century business herald, CBN, national business daily, Securities Times.