Central Bank: The interest rate policy for new commercial personal housing loans will be adjusted.

Cartography: Xu Xiaoxuan (Xinhua News Agency)

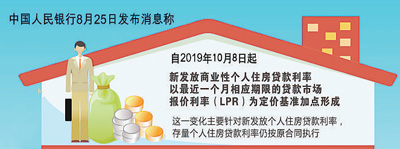

People’s Daily, Beijing, August 25th (Reporter Wang Guan) The People’s Bank of China announced on the 25th that since October 8th this year, the new commercial personal housing loan interest rate has been formed by adding the loan market quotation rate (LPR) of the latest month as the pricing benchmark.

This change is mainly aimed at the new personal housing loan interest rate, and the existing personal housing loan interest rate is still implemented according to the original contract.

After the conversion of the pricing benchmark, the interest rate of the first set of new individual housing loans nationwide shall not be lower than the corresponding term LPR (according to the LPR of more than five years on August 20, 4.85%); The interest rate of two sets of personal housing loans shall not be lower than the corresponding term LPR plus 60 basis points (calculated as 5.45% according to the LPR of more than five years on August 20), which is basically equivalent to the actual minimum interest rate of personal housing loans in China at present. At the same time, the branches of the People’s Bank of China will guide the self-discipline mechanism of interest rate pricing in provincial markets to determine the lower limit of local LPR in time. The added value shall meet the requirements of national and local housing credit policies, reflect the loan risk status, and be fixed within the contract period. Compared with before the reform, the interest expenses of households applying for individual housing loans are basically unaffected.

At present, there are two kinds of quoted interest rates in the loan market: one-year and five-year or more. There is a direct corresponding benchmark for individual housing loan interest rates of one year and more than five years. The benchmark for individual housing loan interest rates within one year and from one year to five years can be independently selected by the lending bank between the two term varieties. After the reference benchmark is determined, the added value can be adjusted to reflect the term spread factor.

It is reported that October 8 is the conversion date of pricing benchmark. Prior to this, the loan bank needs to modify the loan contract, upgrade the system, organize staff training, and at the same time, take various ways to do a good job of publicity and explanation for customers to ensure the smooth and orderly conversion process. Before October 8, the loans that have been issued and signed but not issued are still executed according to the original contract.

The relevant person in charge of the People’s Bank of China said that the interest rate of individual housing loans is an integral part of the loan interest rate system. In the process of reforming and improving the formation mechanism of LPR, the pricing benchmark of individual housing loans also needs to be converted from the loan benchmark interest rate to LPR to better play the market role. At the same time, the personal housing loan interest rate is also an important part of the long-term management mechanism of the real estate market and the regional differentiated housing credit policy. In order to implement the positioning of "the house is for living, not for speculation" and the long-term management mechanism of the real estate market, ensure the smooth and orderly conversion of the pricing benchmark, keep the interest rate of individual housing loans basically stable, and safeguard the legitimate rights and interests of both borrowers and lenders.