Horizon, an intelligent driving company, plans to go public in Hong Kong: last year, its revenue was 1.55 billion yuan, and its gross profit margin exceeded 70%.

After Black Sesame Smart, another smart driving supplier launched an IPO.

According to the website of the Hong Kong Stock Exchange, on March 26th, Horizon, a provider of intelligent driving solutions, officially submitted an application for listing in Hong Kong, with Goldman Sachs, Morgan Stanley and CITIC Jiantou International as co-sponsors.

Horizon is a leading provider of advanced assisted driving (ADAS) and advanced automatic driving (AD) solutions for passenger cars, with proprietary software and hardware technologies. The company’s solution integrates leading algorithms, special software and advanced processing hardware, providing core technologies for advanced assistance and advanced autonomous driving.

According to the prospectus, Horizon is the first and largest China company to provide advanced auxiliary and advanced autonomous driving solutions with mass production before installation in terms of annual installed capacity since the company mass-produced the solutions in 2021.

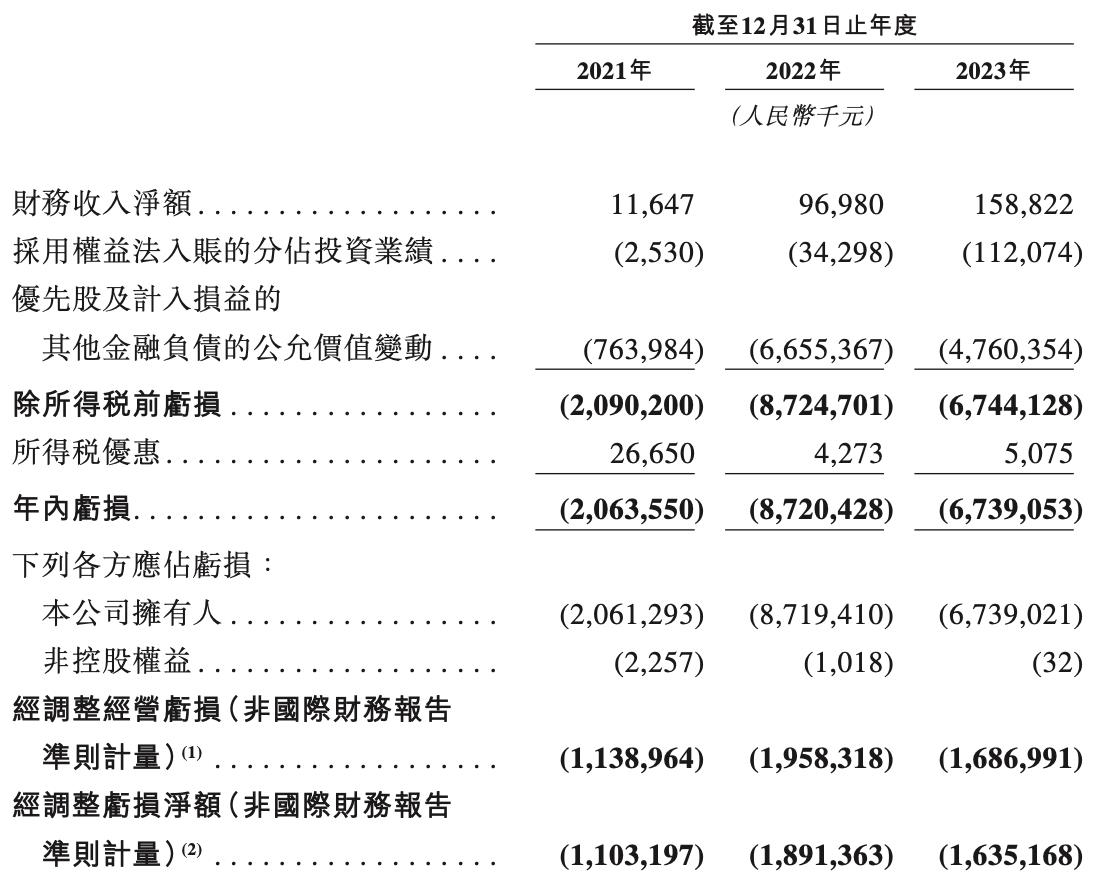

Last year, the income was 1.552 billion yuan and the net loss was 6.739 billion yuan.

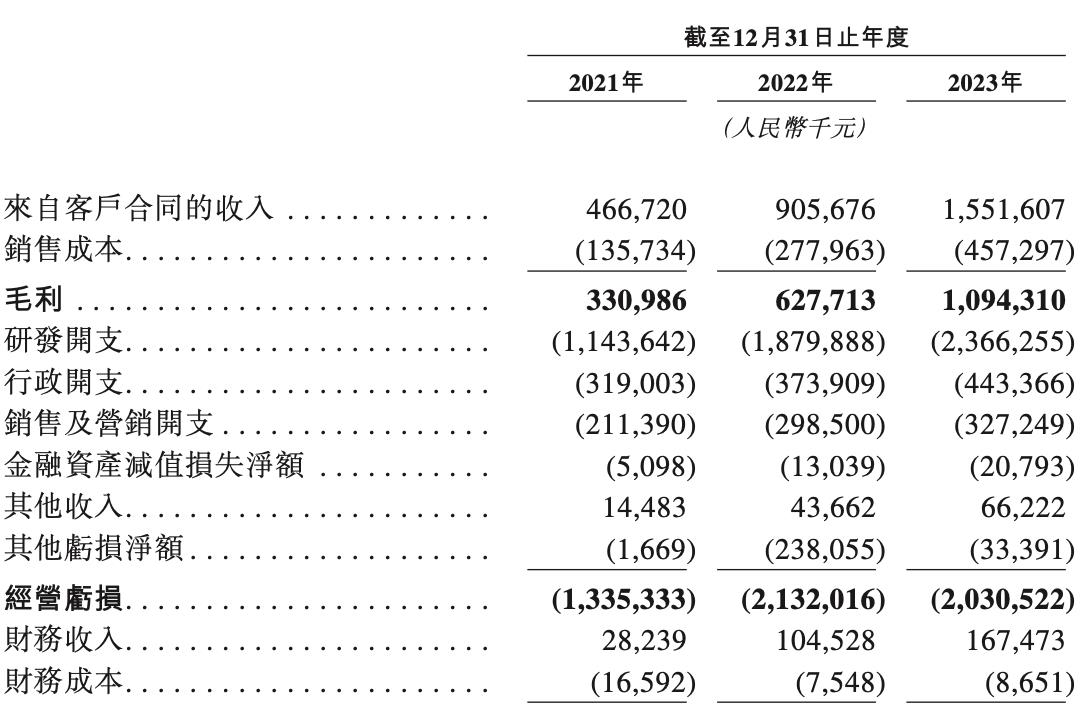

According to the prospectus, Horizon’s revenue in 2021, 2022 and 2023 was 467 million yuan, 906 million yuan and 1.552 billion yuan respectively, and the revenue growth rate in 2022 and 2023 was 94.1% and 71.3% respectively, with a compound annual growth rate of 82.3% from 2021 to 2023.

From 2021 to 2023, the net losses of Horizon were 2.064 billion yuan, 8.72 billion yuan and 6.739 billion yuan respectively; The adjusted net losses were 1.103 billion yuan, 1.891 billion yuan and 1.635 billion yuan.

As far as gross profit margin is concerned, Horizon has a high and stable gross profit margin level. The gross profit margins from 2021 to 2023 are 70.9%, 69.3% and 70.5% respectively.

According to the prospectus, according to the information of burning knowledge consulting, it is estimated that by 2026 and 2030, the sales volume of smart cars in China will reach 20.4 million and 29.8 million respectively, and the penetration rate will reach 81.2% and 99.7% respectively. It is estimated that by 2027, nearly half of the driving automation solutions deployed for passenger cars in China will be advanced automatic driving solutions, and by 2030, the proportion will further increase to over 80%.

In China, the total market size of advanced assisted driving and advanced autopilot solutions will be RMB 24.5 billion in 2023. It is estimated that by 2030, the total market size of China will increase to 407 billion yuan with a compound annual growth rate of 49.4%.

Horizon said that the company’s revenue is expected to increase further by using a large number of order reserves, expanding new markets and launching new solutions with higher prices.

Customers cover mainstream car companies such as BYD and Geely.

According to the prospectus, Horizon is the second largest provider of advanced assisted driving solutions for local OEMs in China, with a market share of 21.3%, based on the installed capacity of solutions in 2023.

It is worth noting that Horizon is the only China enterprise among the top five providers of advanced assisted driving and advanced autonomous driving solutions in China.

As of the last practical date, Horizon’s software and hardware integrated solution has been adopted by 24 OEMs (31 OEM brands) and equipped with more than 230 models. Mainstream car companies including Volkswagen, SAIC, BYD, Geely, Ideality and Weilai, as well as multinational parts giants such as Bosch and ZF are all partners of Horizon.

Horizon emphasized that by December 31st, 2023, the top ten China OEMs were all customers of Horizon.

Horizon’s main products include a comprehensive combination of advanced assisted driving and advanced autopilot solutions, namely, Horizon Matrix Mono, an active and safe advanced assisted driving solution, Horizon Matrix Pilot, a high-speed autopilot (NOA) solution, and Horizon Matrix SuperDrive, an advanced autopilot solution.

Its advanced assisted driving and advanced automatic driving solutions are based on comprehensive technology stack, including algorithms for driving functions, underlying processing hardware, and various tools to promote software development and customization, and have the potential for independent commercialization.

According to the prospectus, Horizon has handled a total of 5 million hardware deliveries, and the installed capacity of advanced assisted driving and advanced autopilot solutions has increased fourfold from 2022 to 2023.

It is worth mentioning that in December last year, CARIAD, a software company owned by Horizon and audi ag, announced the formal establishment of a joint venture company CARIZON. The joint venture company will integrate Horizon’s soft and hard technology capabilities and CARIAD’s experience in the integration of intelligent body and software systems to develop full-stack advanced driver assistance systems and autonomous driving solutions.

After the D round of financing, the valuation is 8.7 billion US dollars, and SAIC holds 10%.

According to the prospectus, Horizon was founded by Yu Kai, Huang Chang, Tao Feiwen and a group of scientists and entrepreneurs in 2015. As of the last practical date, Yu Kai, Huang Chang and Tao Feiwen respectively own 16.95%, 3.82% and 1.66% of the company’s share capital, which is equivalent to 55.95%, 12.61% and 5.47% of the voting rights.

All three founders have Baidu background. Yu Kai is the founder, chairman, executive director and CEO of the company. Yu Kai is an internationally renowned scientist with about 25 years of research and development experience in the field of computer engineering. Before establishing Horizon, he was the vice president of Baidu Research Institute.

Huang Chang is the co-founder, executive director and chief technology officer of the company. Huang Chang used to be the chief R&D architect in Baidu.

Tao Feiwen is the company’s co-founder, executive director and chief operating officer, and previously worked in companies such as Baidu and Google.

According to the prospectus, Horizon has completed 11 rounds of financing before, and after the D round of financing, its post-investment valuation reached 8.71 billion US dollars.

Horizon’s investors include well-known investment institutions such as Sequoia China and Gaoyao Capital, as well as head enterprises from the automobile industry, including SAIC, CARIAD, Contemporary Amperex Technology Co., Limited, BYD and other software companies under Volkswagen Group.

According to the prospectus, SAIC holds 10.02% of the shares through SAIC QIJUN I Holdings Limited; Cariad Estonias, a subsidiary of Volkswagen Group, holds 2.64%; Contemporary Amperex Technology Co., Limited holds 1.12% of the shares through Hongkong Times New Energy Technology Co., Ltd.; BYD holds a 0.13% stake in Horizon through its Golden Link Worldwide Limited.